What is a Child Trust Fund?

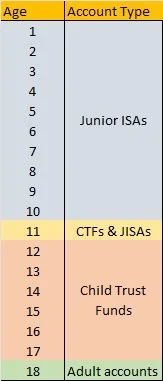

The Child Trust Fund (CTF) is a long-term tax-free savings/investment account for children born in the UK between 1 September 2002 and 2 January 2011. All children within this age range have a CTF set up under Government arrangements, which included an initial payment of £250 or £500 from the Government. It was therefore a universal benefit.

An adult in a position of parental responsibility called the Registered Contact acts on behalf of the Child to make sure that the account is properly invested and operated: the account itself is held with a CTF Provider.

The money in the CTF account belongs to the child but can't be taken out until they are 18. Family and friends can add money to the account up to a limit of £9,000 a year, a limit which runs between birthdays. There is no tax to pay on any income or gains within the account.

Although the Government is no longer making payments to this account, CTFs already in existence continue to operate and be open to voluntary contributions.

We are aware that many families have lost contact with their child's/children's CTF account provider. With the oldest CTF recipient becoming 18 in September 2020, it is important to re-connect with these accounts where they are lost.

Click here to get access to the HMRC's CTF-finder services, through a helpful explanatory service c/o Shares4Schools and TISA (the 'Tax-Incentivised Savings Association).

There is also a simplified search process provided by The Share Foundation and designed particularly for 16/17 year-olds.

When you have successfully discovered the identity of your account provider, you will need to contact them directly to have your registered contact details brought up to date. Click here to find the customer service telephone numbers of the main account providers - if your provider is not shown, please search on the internet to find them, or contact us for further assistance.

Action does need to be taken by your 18th birthday! Click on the graphic below to see your choices, or what will happen if you take no action:

All Looked After children within this age range had CTFs established: where there was no-one in a position of parental responsibility the Official Solicitor , or the Accountant of Court in Scotland, was originally appointed as their Registered Contact. As from October 2017 this responsibility was transferred to The Share Foundation. The transfer and reconciliation process is detailed here.

During the period 2005-2010 The Share Foundation made additional contributions via the Official Solicitor for many of the accounts held for Looked-After children.

See also 'What is a Junior ISA'.